When you’re running a children’s clothing brand—especially one that imports from countries like China—the real cost of a product goes far beyond the factory price. If you’ve ever found yourself caught off guard by extra shipping charges, customs duties, or hidden fees, you’re not alone. Miscalculating landed costs can kill your profit margins and lead to costly mistakes.

Landed cost is the total price a product incurs to reach your warehouse, including product cost, shipping, duties, and all associated logistics fees. Calculating it correctly gives you pricing power, protects your profit, and helps you negotiate better with suppliers.

Whether you’re sourcing newborn bodysuits or toddler outfits, getting this number right ensures you’re not making purchasing decisions based on incomplete data. Let me show you how I, as a factory owner, help clients like Ron from the US calculate landed costs with confidence—and avoid unnecessary financial headaches.

What Is Included in Landed Cost for Baby Apparel?

From a distance, many buyers assume landed cost just means "product + shipping." In reality, it includes a full range of cost components that must be tallied to know your true expenses per unit.

Landed cost includes the FOB price of the baby garment, plus ocean or air freight, customs duties, taxes, handling fees, insurance, and inland transportation to your final delivery point.

What are the essential components of landed cost?

The first component is your factory price, which should ideally be on FOB terms (Free On Board), meaning the cost of the product up to port of departure. Add to that the freight (ocean or air), which varies greatly depending on the mode and distance. Once the cargo arrives, you must account for customs clearance, import duties, and any tariffs applied by the destination country.

You’ll also need to include port handling charges, inland transportation, and cargo insurance. Many US importers overlook destination fees—the local charges at American ports—which can be steep, especially during peak seasons.

How do shipping methods impact total landed costs?

If you’re choosing between air freight and ocean freight for baby clothes, it’s not just about speed—it’s about how weight, volume, and urgency affect the cost. Air freight is typically charged by chargeable weight (whichever is greater: actual or volumetric), while sea freight is calculated by CBM (cubic meter).

For lightweight items like baby rompers, air freight can be deceptively expensive due to volumetric pricing. On the other hand, sea freight is cost-efficient in bulk, but may incur storage or demurrage fees if not cleared quickly.

How to Calculate Duty and Tax for Kidswear in the U.S.?

Many buyers underestimate the impact of duties and taxes on total costs—until they get slapped with unexpected invoices from their customs broker. Understanding these charges upfront is non-negotiable.

For baby clothes imported to the USA, duty rates range from 0% to 32%, depending on fabric type, gender category, and classification under the HS Code system.

What HS codes apply to baby garments?

The Harmonized System (HS) Codes are used globally to classify products and determine duty rates. For instance, cotton baby onesies typically fall under 6111.20.60, while synthetic fiber sleepwear may be classified under 6209.90.00. Each carries a different duty rate—often ranging from 0% for organic cotton babywear to 16.5% or more for polyester garments.

Your supplier or freight forwarder should always confirm the exact HS code, but you must do your due diligence using official sources like the USITC’s HTS search tool or hire a licensed customs broker to avoid surprises.

Are there exemptions or duty-free options?

Yes. For example, GSP (Generalized System of Preferences) may exempt certain countries or items from duties. However, China is currently excluded from GSP benefits.

There’s also Section 321 de minimis, which allows tax-free imports below $800 per day—but that’s more relevant for sample shipments, not bulk orders. Brands should also keep an eye on temporary tariff exclusions and safeguard measures, especially in trade-sensitive categories.

What Role Do Freight Forwarders Play in Landed Cost Accuracy?

When it comes to calculating your true landed cost, freight forwarders are your best ally. A good one doesn’t just move goods—they ensure transparency and efficiency at every stage.

Freight forwarders manage freight booking, customs paperwork, insurance, and final delivery—and they help calculate real-time landed costs based on current rates and policies.

How do forwarders help you forecast total landed costs?

They provide accurate cost breakdowns before you ship—often via DDP quotations (Delivered Duty Paid), which bundle product price, freight, duties, and last-mile delivery into one invoice. These all-in quotes make budgeting easier and remove guesswork.

A reliable forwarder uses tools like cargo management platforms and real-time customs data to forecast your full landed cost within a 2-5% margin. Some even offer customs bond coverage, which avoids delays at US ports.

How to avoid hidden charges from logistics?

Many of our US clients come to us after bad experiences with unprofessional freight agents who charged hidden destination terminal fees or passed on demurrage costs. The key is to work with a forwarder who issues pre-approved DDP breakdowns with cost transparency.

Ask whether their price includes customs clearance, import documentation, and fuel surcharges. Cheap rates without clear coverage often lead to big surprises.

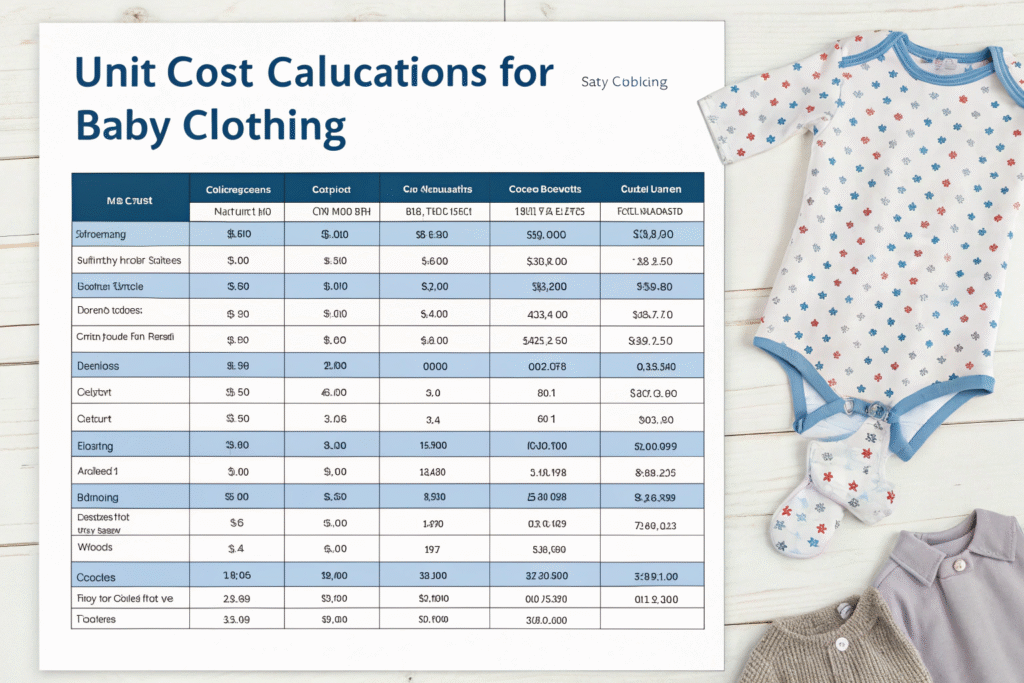

How to Calculate Per Unit Landed Cost for Baby Clothes?

Once you have all cost components, you’ll need to allocate those expenses across your product units to arrive at a precise per-unit landed cost. This is vital for pricing, profitability, and cash flow planning.

Per-unit landed cost = (Total Cost of Goods + Total Freight + Total Duties & Fees + Other Costs) ÷ Total Units.

What tools help simplify per-unit cost calculations?

Excel is a good start, but for brands managing multiple SKUs, using inventory management software or costing tools like Katana is more efficient. These platforms automatically pull in data from purchase orders, freight invoices, and customs declarations.

For example, if your total landed cost for 5,000 baby rompers is $22,000, your per-unit landed cost is $4.40. To this, you’ll add any repackaging costs or warehousing fees if applicable. Keep a buffer to absorb rate fluctuations and seasonal price hikes.

What mistakes do brands make in landed cost math?

Many brands forget to include the cost of packaging materials or labeling compliance in their calculations. Others underestimate duty rates or use outdated freight benchmarks.

Some also divide by shipped quantity rather than sellable quantity, ignoring defective or rejected items. We always recommend our clients build cost models based on historical averages and worst-case scenarios to prevent underquoting.

Conclusion

Accurately calculating the landed cost of baby clothes isn’t just an accounting task—it’s a strategic move that protects your margins, supports smarter sourcing, and reduces logistics friction. From HS code classification to freight selection, every piece matters in the final cost puzzle.

At Shanghai Fumao, we specialize in helping global children’s wear brands optimize their supply chain and pricing. If you’re tired of guesswork and want a reliable partner who can help you source, produce, and ship with full cost transparency, reach out to our Business Director Elaine at elaine@fumaoclothing.com. Let’s bring your next babywear collection to life—with clarity and confidence.